us japan tax treaty withholding rate

Interest in excess of the arms length rate may be taxed at source at the rate not exceeding 5. Japan - Tax Treaty Documents.

Expat Tax Advice For Us Non Residents Living In The Us

5 for holding at least 10 direct or indirect shares for six months.

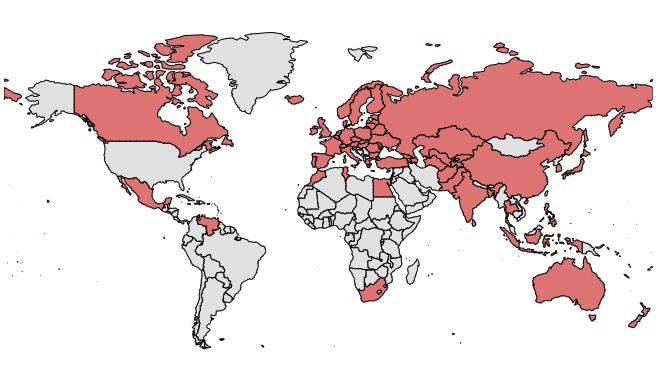

. Summary of worldwide taxation of income and gains derived from listed securities from 123 markets as of December 31 2021. 61 rows Summary of US tax treaty benefits. Therefore the withholding tax rate of 15 under the Income Tax Act applies.

Under US domestic tax laws a foreign person generally is subject to 30 US tax on a gross basis on certain types of US-source income. This section discusses the aspects of Japans tax system that are most relevant to a foreign corporation or individual investing in Japan. 4Article 46 of the Japan-US tax intake is as follows For the purposes of applying this Convention a community item of decay i derived from a Contracting State.

Passbooks for bank accounts usually only show the net so you must divide by 079685. Application Form for Certificate of Residence in Japan. For definition of large holders please refer to the article 10.

The complete texts of the following tax treaty documents are available in Adobe PDF format. 31 Overview of Japanese Corporate Tax System for Investment in Japan 32 Domestic-Sourced Income 33 Overview of Corporate. In an effort to strengthen the bilateral.

0 0 0 Note that a rate of 49 applies in the case of interest and certain dividends where a Tax File Number is not quoted to the payer. US persons making payments withholding agents to foreign persons generally must withhold 30 of payments such as dividends interest and royalties made to foreign persons. Rates National income tax rate Taxable income Rate JPY 18000001 JPY 40000000 40 4084 including surtax Local inhabitants tax rate 10 plus per capita levy of JPY 4000 and JPY 1000 surtax Capital gains tax rate 1530 203153963 including national surtax and local inhabitants tax.

For the purpose of claiming tax treaty benefits PDF207KB. United States and Morocco. The instruments of ratification for the protocol to amend the existing Japan-US tax treaty Protocol were exchanged between the two governments and entered into force on 30 August 2019.

Withholding Tax Rate Afghanistan No 30 Albania No 30 Algeria No 30 American Samoa No 30 Andorra No 30. Japan Inbound Tax Legal Newsletter August 2019 No. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader.

May 24 2021. Emphasis is placed on corporate tax structures tax treaties and personal taxes. Exempted when paid by a company of Japan holding at least 15 direct or indirect or 25 direct shares for six months.

Pension funds are exempt under certain conditions. Article 11 of the United States- Japan Income Tax Treaty allows the source state to impose a withholding tax of 10 percent if paid to a resident of the other Contracting State that beneficially owns the interest. Country Treaty with US.

This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments. 5 when holding at least 10 for six months. O Rate applies to payments for the use of or the right to use any patent design or model plan secret formula or process or for the use of or the right to use industrial commercial or scientific equipment or for information concerning industrial commercial or scientific experience.

The entries for regular post office accounts will show gross income along with withholding tax 20315. Application Form for Income Tax Convention etc. United States Yes 28 Uruguay No 30 US Virgin Islands No 30 Uzbekistan Yes 30.

Exempted when holding at least 25 for 18 months. For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. Principal International Tax KPMG US.

Japan Yes 10 Jordan No 30 Kazakhstan Yes 15 Kenya No 30. On August 30 2019 the governments of Japan and the United States of America exchanged instruments of ratification for a new protocol to the US-Japan Tax. Japan-US Tax Treaty 2013 protocol entered into force on 30 August 2019 the date Japan and the US exchanged instruments of ratification and applies to withholding taxes on dividends and interest paid or credited on or after 1 November 2019.

10 for revenue bonds not exempt Effective from 1 November 2019. For the United States report the gross amount as income then claim the foreign tax credit for the Japanese withholding tax. Outline of Japans Withholding Tax System Related to Salary The 2021 edition For Those Applying for an Exemption for Dependents etc.

Covered taxes in Japan are expanded to include the national consumption tax inheritance tax and gift tax. Large holders of a REIT are not exempt 15315. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev.

2 Non-Resident Withholding Tax Rates for Treaty Countries Non-Resident Withholding Tax Rates for Treaty Countries 133 Country2 Interest3 Dividends4 Royalties5 Pensions Annuities6 France 10 515 010 25 Gabon 10 15 10 25 Germany 10 515 010 025 Greece 10 515 010 1525 Guyana 15 15 10 25 Hong Kong 10 515 10 25 Hungary 10 515 010. The updates to the Japan-US tax treaty included in the 2013 protocol should provide taxpayers with potential benefits including relaxation of the requirements to qualify for the dividend withholding tax exemption and the. The US Japan Tax Treaty is an international tax treaty designed to summarize the tax implication and obligations for Taxpayers in Japan and the United States.

The United States has entered into several international tax treaties with more than 50 countries including Japan. United States of America 0 1 10 0 2 0 2 1. The Tax Treaty between Japan and the United States was first entered.

Although the Protocol was signed on 25 January 2013 Japan time and approved by the Japanese Diet on 17 June 2013. Part of the double tax problem is dealt with in other articles of the proposed treaty that limit the right of a source country to tax income. Japans tax agency on 19 May 2021 released a set of frequently asked questions FAQs with information about nonresidents and other eligible persons that submit requests to seek a reduction or exemption from withholding tax pursuant to a provision of an income tax treaty.

The FAQs address how such treaty-related requests. Been outside the scope of the dividend withholding tax exemption under the Treaty. Of the treaty for double taxation between USA.

2021 Global Withholding Taxes. 30 10 30 Note there are certain exemptions that may apply. With Regard to Non-resident Relatives.

How E 2 Investors Can Attend To Their Investments While Awaiting Their Interviews

Us Taxes Worldwide Income Escape Artist

What Happened When China Joined The Wto World101

Weaponizing Tax Treaties Time To Get Tough With Russia And Cyprus

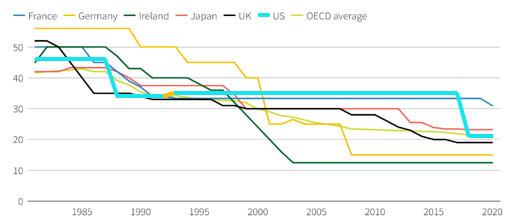

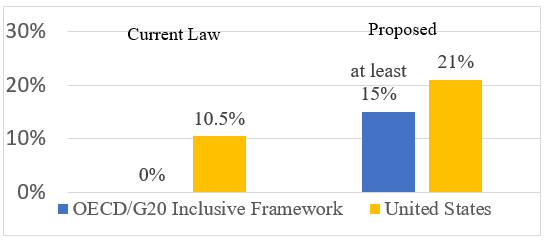

Why The United States Needs A 21 Minimum Tax On Corporate Foreign Earnings U S Department Of The Treasury

How Racial Diversity Shaped U S International Tax Policy

Weathering The Storm Infosys Q4fy20 Result Review Hdfc Securities Share Market Weather Storm

Why The United States Needs A 21 Minimum Tax On Corporate Foreign Earnings U S Department Of The Treasury

Why The United States Needs A 21 Minimum Tax On Corporate Foreign Earnings U S Department Of The Treasury

New Life In U S Housing Market Not Evident In Big Bank Results Housing Market New Homes Mortgage Rates

Avoiding Double Taxation Expat Tax Professionals

What Countries Have The Highest Electric Car Stock Answers World Map Showing Countries Map World

Global Tax Deal Reached Among G7 Nations The New York Times

Unraveling The United States Japan Income Tax Treaty And A Closer Look At Article 4 6 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

Us Expat Taxes For Us Employees On Foreign Assignments

Will Common Ground Between The U S And China Strengthen Their Bond Knowledge At Wharton